Discovery CITI® Diamond Preferred Card

Anúncios

With a substantial presence that includes over 650 branches in the United States, and a multitude of fee-free ATMs across various retail locations, Citibank ensures that clients can access their banking services with ease. These ATMs are strategically placed in accessible venues such as Target, Rite Aid, Duane Reade, CVS Pharmacy, and Walgreens, providing widespread coverage for everyday banking transactions.

Citibank’s commitment to customer service is reflected in the availability of comprehensive online resources for locating the nearest bank branch or ATM. Clients seeking assistance can utilize tools such as the Citi Locator – Citibank to find the closest facility that meets their banking requirements. Furthermore, for those requiring personalized support or additional information regarding hours of operation and services offered, Citibank provides contact details and customer service lines to ensure that all inquiries are promptly addressed.

Facilitating Access to Essential Banking Services

Understanding the local banking landscape is essential for those who require regular access to bank services. Whether one needs to find the nearest Citibank branch for in-person transactions or to locate a fee-free ATM for quick cash withdrawals, the bank’s resources are designed to help customers find the necessary banking solutions without undue hassle.

The emphasis on a seamless customer experience is evident in the user-friendly interfaces and clear communication strategies Citibank uses to guide clients to their nearest banking centers.

Customer Service Assistance

Customers seeking a more personal touch can opt for Customer Service Assistance.

By contacting Credit Cards Diamond Preferred, individuals gain access to professional support for finding the nearest bank branch or ATM. Efficient assistance is provided to help account holders and potential new customers in their search for Citidimond banking services.

Banking Services Offered CITI® Diamond Preferred Card

Citibank offers a comprehensive range of services tailored to meet the financial needs of its customers. They provide personalized solutions for personal and business banking, as well as user-friendly online and mobile banking platforms.

Personal Banking

Citibank’s personal banking services include a variety of checking and savings account options, designed to suit different customer needs. Clients can benefit from competitive interest rates, easy access to their funds, and a range of fee-free ATMs across the nation. Moreover, Citibank offers a broad spectrum of credit card options, from rewards cards to cards geared toward building credit.

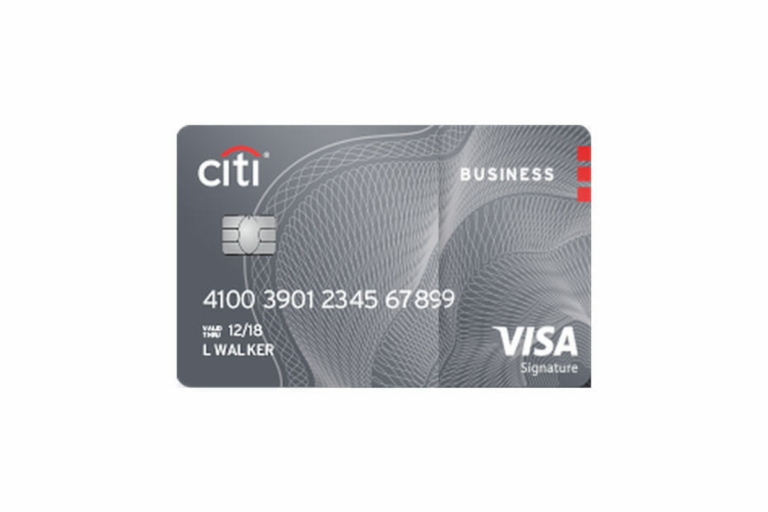

Business Banking

For business clients, Citibank provides robust checking and savings accounts, along with merchant services and commercial lending options. Businesses can find customized financial products to optimize their operations, manage cash flow, and finance growth. Citibank’s business banking solutions also cater to companies of all sizes, ensuring they receive the support they need.

Online & Mobile Banking

Citibank is at the forefront of digital banking with its state-of-the-art online and mobile banking services. Customers can manage their bank accounts, monitor credit card activity, transfer funds, and pay bills with ease on the Citi mobile app or through their online banking portal. Secure and efficient, these platforms exemplify banking convenience in the digital age.

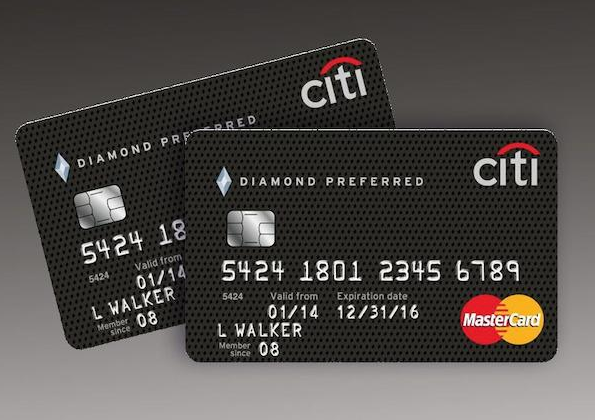

Credit Cards Diamond Preferred

Citidimond offers a range of credit cards suited for different financial needs, from earning rewards to managing balances. Each card is designed with specific features to help cardholders enhance their financial flexibility and enjoy various benefits.

Rewards Programs

Citidimond’s credit cards offer compelling rewards programs. Cardholders can earn points on every purchase, which can be redeemed for travel, merchandise, or cash back. These rewards are designed to provide value for everyday spending as well as larger purchases.

Secured Credit Cards

Individuals with limited credit history or those looking to rebuild their credit can consider Citidimond’s secured credit cards. These cards require a deposit that serves as collateral and credit limit but operate like a regular credit card, reporting activity to credit bureaus to help build a positive credit history.

Investment Options

Citidimond Bank provides its clients with a variety of investment vehicles to expand their portfolios. Clients can choose from:

- Mutual funds

- Bonds

- Stocks

- Exchange-traded funds (ETFs)

Each investment option is selected to align with the client’s risk tolerance, investment timeline, and financial objectives.

In wealth management, CITI® Diamond Preferred Card stands out with its customized approach. Services include:

- Estate planning

- Tax optimization strategies

- Retirement planning

Wealth managers at Citidimond Bank work closely with clients to create a long-term plan that integrates various aspects of their financial life. This holistic approach ensures that each client’s wealth is managed efficiently and with due diligence across all fronts.